5 Tips to Negotiate with an Insurance Company

Having an auto accident and making a personal injury claim can oftentimes be stressful. While you may consider retaining an experienced attorney to assist you with the process and negotiations, you may also decide to work with the insurance company yourself. Here are 5 tips to negotiate with an insurance company or insurance adjuster.

Plan & Prepare

Know The Insurance Policy – knowing your insurance policy, or policies, can help you understand what you can or can’t achieve through the negotiation. Specifically look for how much insurance is available. There could be multiple insurance policies or coverage limits. For example, nearly every insurance policy has a limit on a per person basis and a per accident basis. So you should understand which limit applies to you. Additionally, the at fault party may have an umbrella insurance that provides additional coverage.

Get your Records together – Gather documents supporting your claims. This includes: photographs of damaged vehicles, police reports, medical reports or medical bills. This documentation helps improve the strength of claims by providing evidence and increasing validity of the claims. They also illustrate the your injuries and damages.

Understand your Position – What amount of money would you realistically like to get as a result of the negotiation? This is known as Aspiration Point. What is your best alternative to the negotiation offer? And what offer do you want to start with? Answering these questions before negotiations will help you understand how to proceed.

Establish the Initial Offer – The initial offer is crucial because it anchors the negotiations. It may be tempting to start with an aggressive offer, but doing so may risk your credibility. Instead, start with a number that is both high, but also realistic. This establishes room for negotiations while maintaining the insurance adjusters’ trust.

Establish Trust/Build Rapport

In negotiations each party is motivated by their own interest and is incentivized to claim the most money for their own party. An insurance company is a business, so they are incentivized to pay as little money as possible that will entice you to settle your injury claims. On the other hand, you are incentivized to get as much money as possible to cover all of your expenses. In order to achieve the optimal outcome, it will be important to establish rapport with the adjuster. Empirical evidence suggests that parties that establish rapport at the outset of a negotiation often end up with a more mutually beneficial outcome.

Do not accept the initial offer, or if you do take your time

if the insurance adjuster makes the first offer, it may be tempting to accept the offer right away. Even if the offer is reasonable, take some time to consider it to ensure you are satisfied. If it is unreasonable, ask the adjuster to explain their reasoning. This can help provide you with the information you need to counter their offer and establish additional facts in your favor.

Get the settlement in writing

Many negotiations may happen over the phone, as a result it is important to document the outcome of the negotiations via email to avoid any misunderstandings. All insurance carriers have a standard settlement release agreement that they can provide.

If Settlement Discussions Stall

Sometimes, insurance companies do not take self represented parties seriously and they delay or stall settlement discussions. If this happens, then your recourse may be to seek an attorney with experience. Anderson Franco has extensive experience negotiating with insurance companies and representing injury victims and may be able to help you.

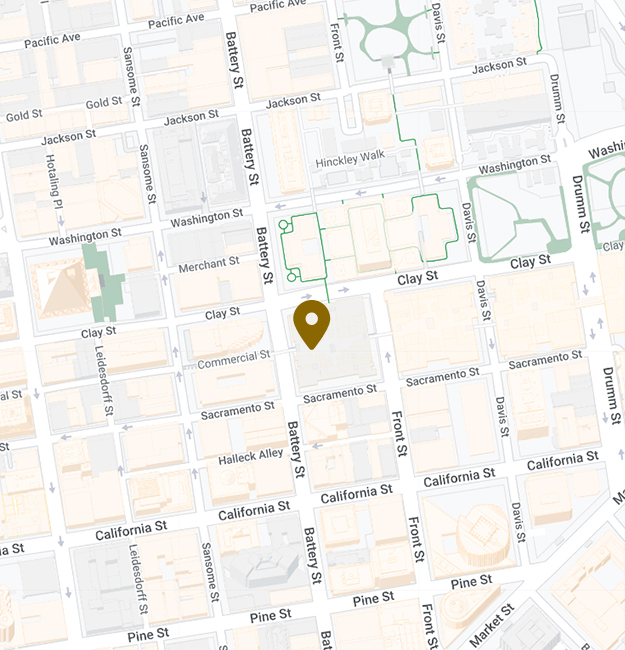

Contact Anderson Franco

We hope these 5 tips to negotiate with an insurance company are helpful. Even so, negotiations can be stressful – but being prepared, maintaining composure throughout the process, and documenting the outcome in writing will help you obtain the best possible outcome. Anderson Franco has extensive experience negotiating with insurance adjusters and insurance companies. Anderson Franco has also represented insurance companies in personal injury actions.

Personal injury victims can contact Anderson Franco via email or telephone.