San Francisco Hit and Run Accident

Being in a hit and run accident can be really stressful and confusing, especially when you’re hurt and the driver who hit you is nowhere to be found. You might think you can’t get any money for your injuries, but that’s not always true. This guide will help you understand your rights and what you can do to get help, even when the driver who caused the accident is unknown.

Understanding Your Own Insurance: Uninsured and Underinsured Coverage

A smart first step in seeking compensation after a hit and run is to review your car insurance policy. This is particularly important as many states, including California, offer specific coverage options for situations involving uninsured (UM) or underinsured (UIM) motorists. These coverage options are designed to protect you in scenarios where the driver responsible for the accident either lacks insurance entirely (UM coverage) or has insurance that is insufficient to cover all of your expenses (UIM coverage). Essentially, UM coverage comes into play if the other driver has no insurance or insufficient insurance. Understanding and utilizing these aspects of your insurance policy can be a crucial lifeline after an accident.

How to File a UM/UIM Claim: Step-by-Step

If you find yourself in the unfortunate position of being a hit and run victim, it’s imperative to promptly notify your insurance company and file a claim for your losses. This immediate action is crucial in kickstarting the process of potential compensation. Upon filing your claim, your insurance company will assess the situation and either approve or deny it. If they approve your claim, they will provide financial assistance for your injuries and related losses. However, if your claim is denied, it’s important to diligently investigate the reasons behind their decision.

Understanding why your claim was denied is essential, as it allows you to verify the validity of their rationale and determine if further action, such as contesting the denial, is warranted. This careful follow-up can be a key step in ensuring that your rights and interests are adequately protected and addressed. The California Department of Insurance also provides consumers with helpful information regarding denied claims.

What to Do If Your Claim Is Denied: Check Your Policy

If your insurance company denies your claim, it’s crucial to thoroughly review your insurance policy. The policy is the binding agreement between you and your insurer. This document outlines the specific circumstances under which they are obligated to provide coverage. Scrutinizing your policy will help you understand the exact conditions and exclusions that apply. If the policy language indicates a valid reason for the denial in relation to your specific accident, then the insurer’s decision may be justified. However, it’s always wise to meticulously examine the details of your policy. This ensures that the denial is in accordance with the terms you agreed to. And it helps you ascertain whether you have grounds to challenge the decision or seek alternative avenues for compensation. Understanding the nuances of your policy is key in navigating the complexities of insurance claims.

Looking at Other Insurance Policies

Occasionally, additional support in covering your losses may come from an unexpected source: the insurance policies of your family members. It’s a little-known fact that if you reside with family members, such as parents, children, or siblings, their insurance policies might extend coverage to you. This is especially true in cases of hit and run accidents. This potential coverage often hinges on the specifics of each policy. This includes who is deemed an “insured” under the policy. Familiarizing yourself with the policy terms can prove to be invaluable. This knowledge equips you with additional options to ensure that you are adequately compensated for your injuries.

Example of How UM/UIM Can Help

Consider the following scenario for a clearer understanding:

Arnold is involved in a hit and run accident while riding in his friend Berto’s car. In this situation, Arnold is not without resources. He has his own car insurance policy, and additionally, he resides with his sister Charmaine, who also maintains her own insurance. This potentially opens up three avenues for insurance claims. First, Berto’s insurance could come into play as Arnold was a passenger in Berto’s vehicle. Second, Arnold’s own insurance might provide coverage, especially if he has UM/UIM (uninsured/underinsured motorist) coverage. Lastly, Charmaine’s insurance could also be a source of compensation, assuming her policy extends to cover household members in such incidents. The key here lies in the UM/UIM coverage of these policies. If the coverage is present, then it enhances Arnold’s chances of receiving adequate compensation for his injuries.

This example underscores the importance of understanding not just your own insurance policy, but also the potential coverage offered by the policies of those close to you.

Getting Legal Help: Making Sure You Get What You Deserve

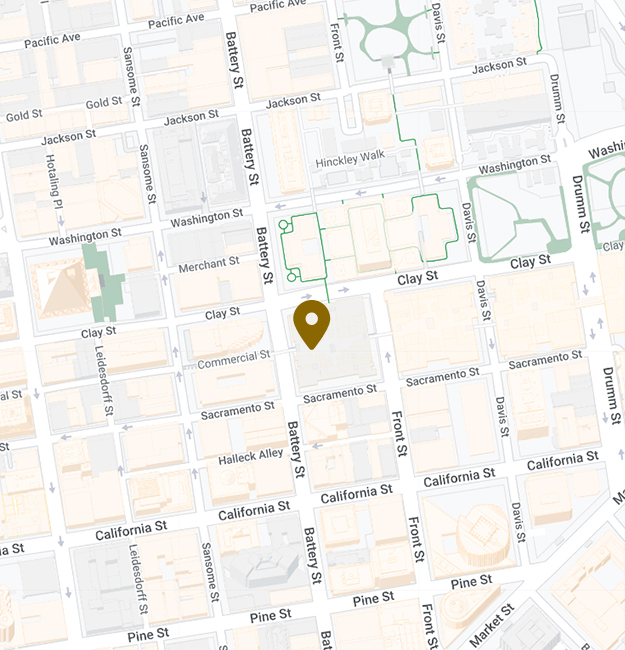

Navigating the complexities of insurance claims in the aftermath of a hit and run accident can be daunting and intricate. In such situations, enlisting the expertise of a seasoned lawyer can be immensely beneficial. A proficient attorney, well-versed in the nuances of personal injury law, increase the liklihood of comp;ensating your injuries . They are adept at exploring every potential avenue for securing financial compensation for your injuries. More than just advisors, lawyers like Anderson Franco vigorously advocate for clients. . Their involvement can be the pivotal factor in transforming a challenging insurance claim process into a more navigable and successful endeavor.