How Does Car Insurance Work?

How Does Car Insurance Work?

Car accidents can turn your world upside down in an instant. One moment you’re driving to work or picking up your kids, and the next, you’re dealing with injuries, car damage, and insurance paperwork. After the shock of the crash wears off, one of the first questions most people ask is: how does car insurance actually work, especially when someone gets hurt?

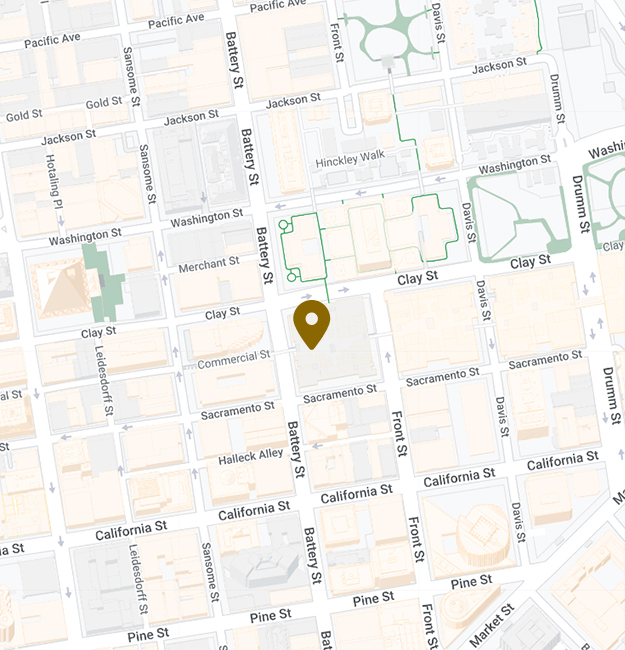

At Anderson Franco Law, we help people across San Francisco and throughout California understand how the car insurance system affects their personal injury claims. This guide breaks down what you need to know about how car insurance works, what your options are after an accident, and how to protect your legal rights.

Understanding the Basics of Car Insurance

Car insurance is a legal agreement between a driver and their insurance company. The driver pays a regular premium—monthly, quarterly, or yearly—and in return, the insurance company promises to cover certain losses when something goes wrong. In California, the law requires every driver to carry a minimum amount of car insurance coverage. This includes liability insurance, which covers injuries and property damage that you cause to others in an accident.

But most drivers don’t realize how many types of coverage may be included in or added to their policy. Some common types of insurance include:

- Bodily injury liability: Covers injuries you cause to someone else in a crash.

- Property damage liability: Pays for damage to another person’s car or property.

- Medical payments coverage (Med Pay): Pays for your medical bills regardless of who was at fault.

- Collision coverage: Helps pay to repair or replace your car after a crash.

- Comprehensive coverage: Covers non-accident events like theft, fire, or weather damage.

- Uninsured/underinsured motorist coverage: Protects you if the driver who hit you doesn’t have insurance or doesn’t have enough insurance.

Not every policy includes all of these options. That’s why it’s important to review your coverage regularly and understand what’s included before an accident happens.

What Happens After an Accident

If you’ve been in a car accident, the first step is to make sure everyone is safe and to call emergency services if needed. After that, you should exchange information with the other driver and take photos of the scene. Once you’ve left the scene, it’s time to notify your insurance company.

When you report the crash, your insurance adjuster will likely ask you for a detailed account of what happened. They may want to see photos, a copy of the police report, and a list of damages or injuries. They may also send someone to inspect your car. If you were injured, you should also begin documenting your medical care and how the injuries are affecting your daily life.

It’s important to know that car insurance companies don’t automatically pay the full value of your claim. They often look for ways to reduce what they owe by questioning the extent of your injuries, arguing about fault, or offering a quick settlement that doesn’t cover everything. That’s why it’s wise to speak with a personal injury attorney early in the process. A lawyer can make sure the insurance company treats your claim fairly and doesn’t take advantage of you when you’re vulnerable.

Who Pays for Your Medical Bills

After a car accident, one of the biggest concerns people have is how to pay for their medical treatment. If another driver caused the accident, their insurance company should be responsible for covering your medical bills through their bodily injury liability coverage. But that coverage may not kick in right away—and it might not be enough.

California’s minimum liability limits are $15,000 per person and $30,000 per accident. If you were seriously hurt, your hospital bills alone might be higher than that amount. In the meantime, you may have to use your own health insurance or Med Pay coverage to get the care you need.

If you use health insurance, your provider may later request reimbursement from your settlement. This is called subrogation. While it’s legal, it can be frustrating and confusing. The good news is that a personal injury lawyer can help reduce these repayment claims and maximize what you keep from your case.

Uninsured and Underinsured Drivers Car Insurance

Unfortunately, not everyone on the road follows the law. Some drivers carry no car insurance at all. Others only have the bare minimum, which might not be enough to cover your losses. If one of these drivers hits you, your options depend on whether you have uninsured/underinsured motorist coverage—also known as UM/UIM.

UM/UIM is optional in California, but it’s highly recommended. It acts like a backup plan, stepping in to cover your injuries when the at-fault driver can’t. This coverage can pay for medical bills, lost wages, and pain and suffering.

However, filing a UM/UIM claim can be just as difficult as dealing with another driver’s insurance company. Even though you’re working with your own insurer, they may still challenge your claim or push for a low payout. In many cases, you’ll need to go through arbitration or litigation to get the full amount you’re owed. An experienced attorney can help you navigate this process and hold your insurance company accountable.

What if the Insurance Company Denies Your Claim

It’s frustrating and stressful when an insurance company denies your injury claim, especially if you’re still recovering from your injuries. Denials can happen for many reasons. The insurance adjuster might say you were at fault, that you delayed getting medical treatment, or that your injuries aren’t related to the accident. They might even claim that you weren’t hurt badly enough to justify compensation.

Getting a denial letter doesn’t mean you’re out of options. You have the right to challenge the decision and present evidence to support your claim. This could include medical records, expert opinions, accident reports, and witness statements. In many cases, insurance companies change their minds once they realize you have a lawyer who’s prepared to fight back.

At Anderson Franco Law, we’ve helped countless clients overturn claim denials and recover compensation after an accident. We know how insurance companies operate, and we know how to build strong, persuasive cases that get results.

How a Personal Injury Lawyer Can Help With Car Insurance

Car insurance companies have teams of adjusters, lawyers, and investigators on their side. You deserve someone on your side too. A personal injury lawyer levels the playing field and ensures your rights are protected every step of the way.

At Anderson Franco Law, we take the time to understand your story, explain your legal options, and build a case that reflects the true impact the accident has had on your life. We deal with the paperwork, phone calls, and negotiations so you can focus on healing.

We’re here to help with every part of your case—from investigating who was at fault to gathering your medical records to negotiating with the insurance company. If needed, we’re ready to go to court to fight for what you deserve.

You Don’t Pay Unless We Win

Many people hesitate to call a lawyer because they worry about the cost. But with Anderson Franco Law, you don’t pay anything unless we win your case. We work on a contingency fee basis, which means our payment comes from a portion of your settlement. If there’s no recovery, you owe us nothing.

This makes it possible for anyone—regardless of income—to get the legal help they need after a car accident.

Anderson Franco Law: Know Your Rights and Protect Your Future

Car insurance is supposed to help you recover after a crash, but the reality is often much more complicated. If you were injured in an accident, you may be facing medical bills, missed work, and long-term pain. Insurance companies may try to minimize your claim or deny it altogether. But you don’t have to face them alone.

At Anderson Franco Law, we believe that every injured person deserves support, respect, and justice. Our team is here to help you understand your rights, deal with the insurance companies, and recover the compensation you need to move forward.

If you or a loved one has been injured in a car accident, contact us today for a free consultation. We’re ready to fight for you.