How To Negotiate a Car Crash Case Like a Lawyer

How To Negotiate a Car Crash Case Like a Lawyer

Car accidents happen fast. One second, everything is normal. The next, your car is damaged, your body is in pain, and your phone is full of insurance calls and medical bills. If you were injured in the crash, it can feel even more overwhelming. You may wonder whether you’re entitled to compensation, and if so, how to get the best possible result.

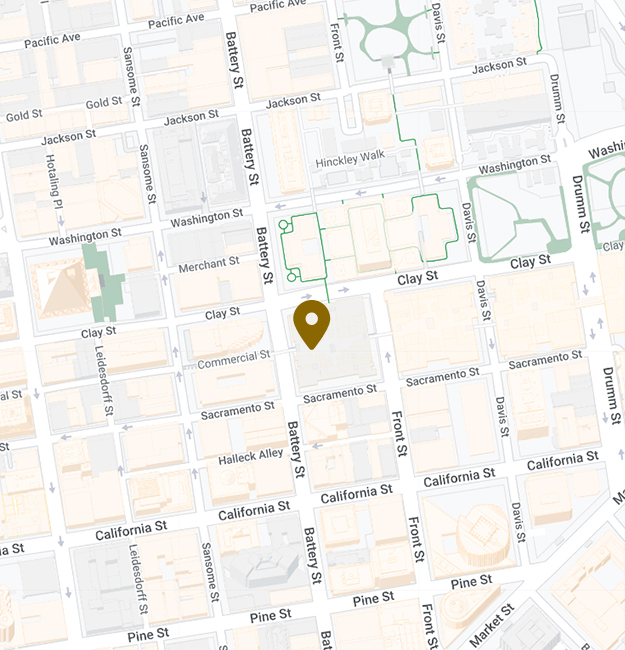

At Anderson Franco Law, we represent people throughout California who have been injured in car crashes. One of the most important things we help our clients with is negotiating their personal injury case. This blog post will walk you through how to negotiate a car crash case like a lawyer. We’ll explain how to evaluate your claim, deal with the insurance company, and secure the compensation you deserve.

Understand the Value of Your Case

Before you can negotiate, you need to know what your case is worth. This starts with looking at the damages you’ve suffered. In legal terms, “damages” are the ways in which you were harmed. There are two main types: economic and non-economic.

Economic damages include things like medical bills, car repairs, and lost wages. These are easier to calculate because they’re based on real numbers. If you went to the emergency room, had follow-up visits, or needed physical therapy, those costs add up. If you missed work or can’t return to your job, your lost income matters too.

Non-economic damages are harder to calculate. These include pain and suffering, emotional distress, and loss of enjoyment of life. If the accident made it hard for you to care for your kids, go to school, or sleep at night, that matters. A lawyer will often look at the total impact the crash had on your daily life when estimating non-economic damages.

To negotiate like a lawyer, you must add up these damages, estimate a fair value for your case, and prepare to explain how you got to that number.

Gather and Organize Your Evidence To Negotiate a Car Crash Case

Good evidence is the backbone of any successful negotiation. The more proof you have, the stronger your case. Lawyers gather evidence from day one to support their arguments and build credibility with the insurance adjuster or opposing attorney.

You’ll want to collect all of your medical records, doctor’s notes, and bills. If you had diagnostic imaging like X-rays or MRIs, include those too. Also, get documentation from your employer showing the days you missed work and any statements about how your injury has affected your ability to do your job.

Photos can be powerful. If you have pictures of the crash scene, damaged vehicles, or visible injuries, organize them by date and label them clearly. If witnesses saw what happened, ask them for written statements or make sure their contact information is available.

A police report or traffic collision report is also useful. These reports often include a diagram of the crash, the officer’s opinions, and other helpful details.

Finally, keep a personal injury journal. Write down how you feel each day, what symptoms you have, and how the crash is affecting your daily life. This type of documentation helps explain your pain and suffering in a human, relatable way.

Deal with Insurance Adjusters Strategically

Once you file a claim, the insurance company will assign an adjuster to your case. This person may seem friendly, but their job is to save the insurance company money. Many injured people make the mistake of giving a recorded statement or accepting a lowball offer too soon.

A lawyer knows not to rush into a settlement. Instead, they wait until their client has finished treating or reached maximum medical improvement. That way, they have a full picture of the injuries and future medical needs.

If you’re negotiating without a lawyer, be polite but firm. Do not agree to a recorded statement. You are not legally required to give one. Provide documents that support your case, but be careful about what you say. Never minimize your injuries or admit fault.

When the insurance company makes an offer, take your time to review it. Compare it to your own estimate of your damages. If it feels too low, it probably is. A lawyer will write a detailed demand letter explaining why the offer doesn’t meet the legal or factual standards required. You can do the same by explaining the extent of your injuries and including your evidence.

Write a Persuasive Demand Letter

A demand letter is a formal request for compensation. Lawyers use this tool to start the negotiation process on strong footing. If you want to negotiate like a lawyer, you’ll need to write a clear and persuasive letter that outlines:

- What happened in the crash

- Why the other party was at fault

- The injuries and losses you experienced

- The total compensation you’re seeking

The letter should be professional in tone. Include your supporting documents as attachments. Be clear about deadlines. For example, give the insurance company 30 days to respond. This shows that you are organized and serious.

Remember, the goal is not just to demand money, but to tell your story in a compelling way. Insurance companies are more likely to settle when they understand the full scope of harm.

Know When to Push Back

Insurance companies often respond to your demand letter with a lower offer. This is part of the negotiation process. Don’t panic. Lawyers rarely accept the first offer, and you shouldn’t either unless it’s fair and supported by evidence.

You can respond by restating your key points. Highlight the strength of your evidence and why your number is fair. If the insurance company is missing key facts, bring them up. If they’re trying to shift blame onto you, explain why that’s incorrect using the crash report or witness statements.

Be respectful but confident. Let them know you are willing to continue negotiating, but only for a fair resolution. Lawyers are not afraid to say “no” when a deal doesn’t reflect the reality of the injuries.

Understand the Power of Patience

Lawyers know that patience can lead to better results. Insurance companies often pressure people to settle quickly. They may say things like, “This is the best offer you’ll get,” or “If you wait, your claim might close.”

But in many cases, the longer you wait, the stronger your case becomes. This is especially true if you are still getting treatment or recovering. Waiting gives you more time to collect records, calculate damages, and understand the long-term effects of your injury.

It also sends a signal that you’re not desperate. Insurance adjusters are trained to spot when someone just wants a quick payout. When you show that you’re willing to wait for what’s fair, it can shift the power dynamic in your favor.

Be Ready to Walk Away or File a Lawsuit

Sometimes, negotiations stall. The insurance company may refuse to offer fair compensation. When that happens, lawyers are ready to file a lawsuit. You can too, although it’s wise to consult with a lawyer before doing so.

Filing a lawsuit doesn’t always mean going to trial. Often, it pushes the insurance company to take your claim more seriously. Discovery allows you to collect even more evidence, and depositions can expose weaknesses in their case.

The threat of trial is a powerful tool. It shows that you are committed to pursuing justice, even if it takes more time and effort. Many cases settle shortly after a lawsuit is filed or during mediation.

Know When to Get Help From a Lawyer

You can start negotiating your own case, but there are times when hiring a lawyer is the smartest choice. If your injuries are serious, the medical bills are high, or the insurance company is blaming you for the crash, legal help is essential.

At Anderson Franco Law, we help injured people navigate these complex situations every day. We don’t charge anything up front. We only get paid if we win. That means we’re motivated to get you the highest compensation possible.

Even if you’re not ready to hire a lawyer, we’re happy to answer your questions. Understanding your rights and options is the first step toward recovery.

Final Thoughts On How to Negotiate a Car Crash Case

Negotiating a car crash case is not easy, but with the right approach, you can do it like a lawyer. Start by understanding what your case is worth. Gather strong evidence. Communicate carefully with insurance adjusters. Write a solid demand letter. Push back when needed. Be patient. And most of all, stay focused on what you deserve.

If at any point you feel overwhelmed or unsure, reach out to Anderson Franco Law. We’re here to help you every step of the way.