State Farm Won’t Pay Medical Bills

State Farm Won’t Pay Medical Bills After Accident?

After a car accident, the last thing anyone expects is for their own insurance company to delay or refuse payment of their medical bills. Yet, many people insured with State Farm find themselves in exactly this situation. You trusted that your insurance would support you when you needed it most. Now you are left wondering what to do next. If State Farm won’t pay your medical bills, it is important to understand your options, your rights, and how an experienced lawyer can help you fight back.

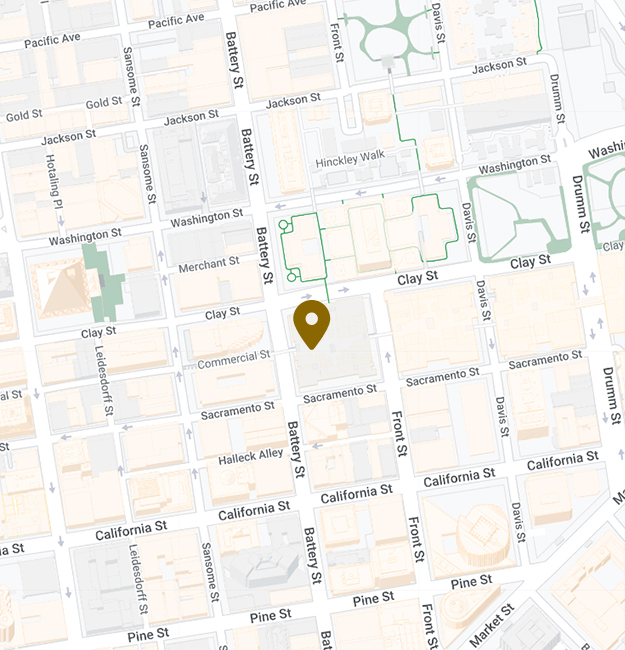

At Anderson Franco Law, we have helped countless clients across San Francisco and California who faced roadblocks from insurance companies like State Farm. You are not alone in this fight.

Why State Farm Might Deny Your Medical Bills

When you submit a claim for medical expenses after an accident, you expect prompt and fair payment. Unfortunately, insurance companies sometimes use different reasons to deny claims, delay payments, or underpay what is owed. In our experience, these are some of the most common reasons State Farm might deny or delay payment of your medical bills:

Sometimes, the insurance company argues that there was missing or incomplete information. Other times, they claim that your treatment was not medically necessary or that your injuries were caused by a pre-existing condition rather than the accident itself. In some cases, State Farm points to fine print in your policy to argue that certain treatments are excluded.

Deadlines can also trip people up. If you do not report the accident or submit your medical bills within certain timeframes, State Farm might use that as an excuse to deny your claim. Sadly, some denials happen because of what we call “bad faith” insurance practices, where companies wrongfully delay or deny payment in the hope that frustrated policyholders will simply give up.

Whatever excuse State Farm gives, remember: a denial is not the end of the road. You have rights, and you have the power to push back.

What Happens When State Farm Insurers The Other Car

In some cases, State Farm is not your insurance company at all. Instead, they insure the driver who caused your accident. When that happens, State Farm acts as the “third-party” insurance carrier, and the way they handle your medical bills is very different.

Unlike your own insurance company, a third-party insurer like State Farm has no legal obligation to pay your medical bills as they come in. Instead, they only have to pay once you reach a full and final settlement of all your claims. In fact, it is common for State Farm to refuse paying any portion of your medical bills until you agree to sign a release, which dismisses your right to pursue any further compensation related to the accident.

This puts injured people in a difficult position. You might be facing thousands of dollars in medical debt, while State Farm holds the money you need until you give up your legal claims. They use this pressure to try to force quick settlements for far less than what your case is truly worth.

It is important to know that you do not have to accept an unfair offer just to get your medical bills paid. You have the right to pursue the full value of your injury claim, including all medical expenses, pain and suffering, lost wages, and future damages. An experienced lawyer can help you navigate this process, negotiate with State Farm, and ensure you are not forced into an unfair settlement.

At Anderson Franco Law, we have seen these tactics many times before. We know how to push back against unreasonable settlement demands and fight for the compensation our clients deserve.

State Farm Must Pay Your Medical Bills if You Have MedPay Coverage

Sometimes, even if State Farm is your own insurance company, they still refuse or delay paying medical bills. However, if you purchased Medical Payments Coverage—also known as MedPay—as part of your auto insurance policy, State Farm has a legal obligation to pay your accident-related medical bills, up to the limits of your coverage.

MedPay is a special type of insurance that covers medical expenses for you and your passengers after an accident, no matter who caused the crash. Unlike bodily injury coverage, which usually requires proving fault, MedPay is designed to pay quickly and without disputes over liability. It can cover hospital visits, doctor’s appointments, surgery, ambulance fees, X-rays, and even some rehabilitation costs.

If you have MedPay coverage and submit your medical bills properly, State Farm must pay them promptly. They cannot force you to settle your entire injury claim first. They cannot make you give up your rights to future claims just to get these bills paid. The whole purpose of MedPay is to provide immediate help when you are injured and need treatment.

Unfortunately, we have seen situations where State Farm tries to delay MedPay payments or denies valid charges by arguing that the treatment was unnecessary or unrelated to the accident. If this happens to you, it is important to know that you have the right to enforce your policy and demand the benefits you paid for.

What You Should Do If State Farm Refuses to Pay

If you are dealing with unpaid medical bills after an accident and State Farm has refused to pay, do not lose hope. There are important steps you can take to protect yourself and strengthen your case.

First, read any letters you receive from State Farm very carefully. They are required to explain why they are denying your claim. Understanding their reasoning will help you respond appropriately.

Next, collect all of your supporting documents. This includes your medical records, bills, accident reports, photographs from the accident scene, and any communications you have had with the insurance company. Having organized, complete records can make a huge difference.

It is also a good idea to review your own insurance policy. Sometimes insurance companies misinterpret or misapply policy language. Make sure you know what coverage you actually purchased and what benefits you are entitled to receive.

If you believe the denial was wrong, you can file an internal appeal with State Farm. This involves sending a written request for them to reconsider their decision, along with any new evidence or arguments supporting your claim.

However, you do not have to navigate this process alone. In fact, involving an attorney early often leads to better outcomes. Insurance companies take claims much more seriously when they know you have a skilled lawyer on your side.

How Anderson Franco Law Can Help You

At Anderson Franco Law, we understand how overwhelming it is to deal with if State Farm won’t pay. We understand that medical bills pile up while fighting an insurance company that refuses to pay. You may be facing collections, worrying about how to afford future treatment, and feeling betrayed by the system you thought would protect you.

Our team is here to shoulder that burden for you. We can step in to communicate directly with State Farm on your behalf, ensuring that your rights are respected. We will review your insurance policy, gather the necessary evidence, and build a strong case to demand the benefits you are owed. If necessary, we are prepared to take your case to arbitration or court.

We pride ourselves on treating every client with the care, respect, and dedication they deserve. Our goal is to maximize your recovery so that you can focus on healing, not fighting an insurance company.

You Are Not Alone – Contact Anderson Franco Law Today

If State Farm won’t pay your medical bills, it can feel like you are fighting an uphill battle. But you are not powerless, and you do not have to do it alone. Legal help is available, and taking action today can make all the difference for your future.

If you or a loved one are dealing with how to pay medical bills after an accident, we encourage you to reach out to Anderson Franco Law. We offer consultations where we can listen to your story, explain your options, and help you plan the best path forward.

Let us stand up to the insurance company for you. Contact Anderson Franco Law today to get the support and representation you deserve.